The Happy CFO: How Finance helps Society

Can a CFO be Happy?

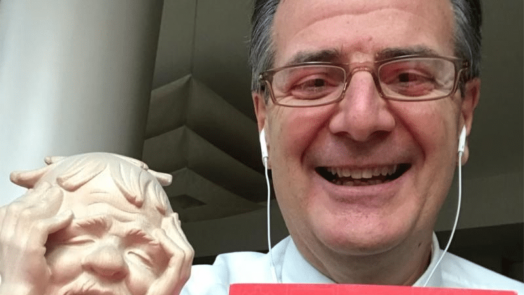

Last year my unit overachieved Budget: we grew double digit, we increased profitability, market share was up, too. During the pre Christmas party, I had this picture being taken and I used it to thank the many that contributed to such a success. I called it ‘The Happy CFO’. All targets were over achieved, my unit was in great shape: shouldn’t be the time to share positive feelings, emotions and happiness? I was so happy and content of the achievement and enjoying absorbing the happiness of the many colleagues in the same situation. I sent many Xmas cards using that picture and many colleagues were surprised: “Happy” and “CFO” seem an oxymoron. “Many other adjectives would go with CFO but ‘Happy’ shouldn’t” they said.

Unbelieving, I surfed the Web: they were true. Google did not find neither correlation nor constant match. Very few lines of the search engine had the two words together. Then I took a pillar book on Finance by Robert J. Shiller, co-creator of the Case/Shiller Real Estate Index and Yale University world known Professor, – “Finance and the Good Society” – in the section where he lists the various roles in Finance careers, and searched if happiness and emotions could be part of the roles. With despair, I read : “An accountant has to keep emotional distance from the people and organizations he or she serves, so as not to be drawn into any of their machinations. Of particular importance, a corporate accountant must feel a general sense of symphaty for the various claimants to the organization’s purse, so as to remember all of them and trait them fairly.” Maybe, when the book was written in 2012, right after the big financial crisis and the disillusion of many towards Finance and Financial institutions, when the protests against Wall Street, Banks and many corporations were still strong, it was evident that being an independent Finance professionist could have been a way to limit some of the excesses happened in the pre 2008 crack. The way Shiller defines the CFO as someone that has to keep emotional distance seems to explain why, at a first glance, being Happy cannot be a status of the CFO.

When a CFO can be Happy?

In my opinion, we need Happy CFOs. A Happy CFO has reached the short term objectives of his or her unit without compromising the long term sustainability. He or she has then optimized the use of money.During the year, I was holding “the purse” (by the way the word budget comes from the French “bougette” word for purse) and with what we, in my unit, call the “Dynamic Resource Allocation”, I tried to “make Happy” all my ‘claimants colleagues’. Through this constant optimization, I make sure to minimize the waste of Financial resources. Finance in a company aims to properly distribute resources in order to guarantee the long-term sustainability of the scope the unit has and to improve its growth. My intent has then to be positive, trying to understand the ‘machinations’ of my business colleagues, and it could only be achieved with intellectual and brain power but also with a lot of empathy, understanding a bit also the humane side of the budget owners. When the objectives are reached, it means that the unit the CFO works for is in line with its broader scope. For my unit, for example, providing solutions to cancer patients. Then embedded in a broader scope, when numbers turn in the right direction, the CFO feels his or her role accomplished. The whole Society benefits for proper use of money. Happiness comes.

Can both the CFO and the CEO be Happy?

Shiller continues describing the CEO/CFO relation: “A CEO cannot double as the accountant or chief financial officer (CFO) of an organization. Humane impulses to be manipulative and self-dealing are too strong. There is necessarily a degree of conflict of interest between the CEO and the CFO – a conflict that is built into the very model of the modern organization. The CEO is supposed to be visionary, looking to the future. The CFO remembers commitments and resource limits, with an eye to the promises of the past and the realities of the present”

EY, one of the Big 4 Audit companies, sees it differently: “On a traditional model, the CFO position might have been considered to be solely focused on past performance, on the numbers, and on financial reporting. But today that mandate seems almost universally to have been exceeded, with the CFO providing not only financial planning and analysis, but information about where the business is going and how quickly it is getting there. Almost all our interviewees attest CFOs to being deeply involved in supporting and enabling strategy, but a good number of them suggest they are developing and setting it outright. And most work side-by-side with the CEO. Involvement in corporate strategy has become an integral part of the job. CFOs now have the ability and the mandate to contribute directly to the direction of the business as well as reviewing and reporting on its performance. It seems only logical that since CFOs now contribute much more significantly to organizational strategy and operational success, these top-level executives rely not only on financial analytics but on a degree of reflection and insight as well — to understand not only where the business has been, but where it’s heading.”

CFOs must be an independent thinker and approach in a very factual way the plans of his or her organization. Shiller’s description is a bit far from what a modern CFO is expected to be doing today. With complexity, speed and dynamism of nowadays activities, the CFO has to get really deep in understand the past – “If you’re no good at financial analysis, you cannot be the CFO. That goes without saying,” said Luca Maestri, Apple CFO – and have to have a balanced view of the future.

The CEO/CFO relation in modern corporations it is essential to create balance and also Shiller accepts that “CFOs are responsible for ensuring that financial appearance matches reality and it is ultimately through their efforts that through their efforts we trust our business enough to find it motivating and even inspiring to work for them and invest in them”.Ultimately then the CFO certifies the outcome of the unit, he/she reassures the CEO that the unit is in the right trajectory and then both can be Happy and proud of the job done together.

The Happy CFO and the Good Society

It is then clear that in a world where human organizations strives to optimize use of scarce resources, including Financial assets, finding many Happy CFOs means improved use of resources and ultimately better outcomes.Borrowing the more authoritative words from Shiller: “We need a system that allows people to make complex and incentiving deals to further their goals, and one that allows an outlet for our aggressions and lust for power. It must be a system that redirects the inevitable human conflicts into a manageable arena that is both peaceful and constructive.”

My article is too short to explain more in detail the link between the Good for Society and the Happy CFO but one of the conclusive sentences in Shiller’s book: “What I want most for my students – near and far, young and old – to know, is that finance truly has the potential to offer hope for a more fair and just world, and that their energy and intelligence are needed to help serve this goal.” offers in my opinion justice to the role that a Financial resource optimizer as the CFO has in Society.

That’s why I am the Happy CFO.